I asked Chatgpt the following question;

Could you explain why existing houses that are sold in Australia are excluded from the Consumer Price Index calculations?

It just doesn't make sense to me considering "Inflation is commonly defined as the decline in the purchasing power of money" and a house be it new or second hand costs money.

Here's Chatgpt's response:

This is an excellent and important question — and one that economists, policymakers, and the public have debated for years.

Let’s break this down clearly:

I asked Chatgpt the following question; Could you explain why existing houses that are sold in Australia are excluded from the Consumer Price Index calculations?

It just doesn't make sense to me considering "Inflation is commonly defined as the decline in the purchasing power of money" and a house be it new or second hand costs money.

Here's Chatgpt's response:

This is an excellent and important question — and one that economists, policymakers, and the public have debated for years.

Let’s break this down clearly:

First, restating the problem:

Inflation is commonly defined as the decline in the purchasing power of money, usually measured by the Consumer Price Index (CPI).

CPI tracks changes in the cost of a fixed "basket" of goods and services.

Existing houses, despite their growing prices and impact on affordability, are not included in that basket.

Yet, housing costs have exploded, and people feel poorer — so why isn't that reflected in "inflation"?

? The Core Answer:

CPI measures consumption, not asset prices.

Buying an existing house is treated as purchasing an asset, not consuming a good or service. And CPI is meant to track the cost of living, not the cost of wealth-building.

? Why this feels wrong to many people:

You're absolutely right — in real life, people feel poorer because:

House prices rise faster than wages.

Renters can’t afford to buy.

Owners feel "richer," but only on paper unless they sell.

So while CPI inflation might look low, housing affordability is deteriorating rapidly — and CPI doesn't capture that fully.

? But doesn’t housing affect living costs?

Yes — and that’s why some housing-related costs are included in CPI:

New dwelling construction (excluding land) — included in Australia's CPI.

Rent — included.

Maintenance and repairs — included.

Property rates and insurance — included.

But existing home purchase prices and land values are excluded because:

They’re considered investment purchases, not consumption.

They don’t reflect ongoing cost-of-living expenses the same way food, transport, or energy do.

? Real-world impact:

Let’s say house prices rise 20% in a year, but CPI says inflation is 3%.

For a first-time buyer, this feels like inflation — they’re spending more money to buy the same thing.

But from a CPI perspective, they’re buying an asset, not consuming a good.

That inflation is not captured in the official figure, even though it dramatically affects people’s real experience of affordability.

? Alternatives and critiques:

Many economists and housing advocates argue that CPI understates real-world cost pressures — especially in countries like Australia where:

Homeownership is a cultural and economic goal.

Housing has become a major driver of inequality.

Some alternatives include:

"Cost of living" indexes that include home purchase costs.

Eurostat’s experimental Owner-Occupied Housing (OOH) Index.

New Zealand's efforts to develop a Housing Cost Indicator.

? Summary:

Aspect

CPI Covers?

Why/Why Not

Rent

✅ Yes

Ongoing cost of consumption

New home construction

✅ Yes

Involves production (excl. land)

Existing home purchases

❌ No

Treated as investment/asset

Land value

❌ No

Not consumed, finite resource

Mortgage interest (Australia)

❌ No

Excluded (unlike in some countries)

? Bottom Line:

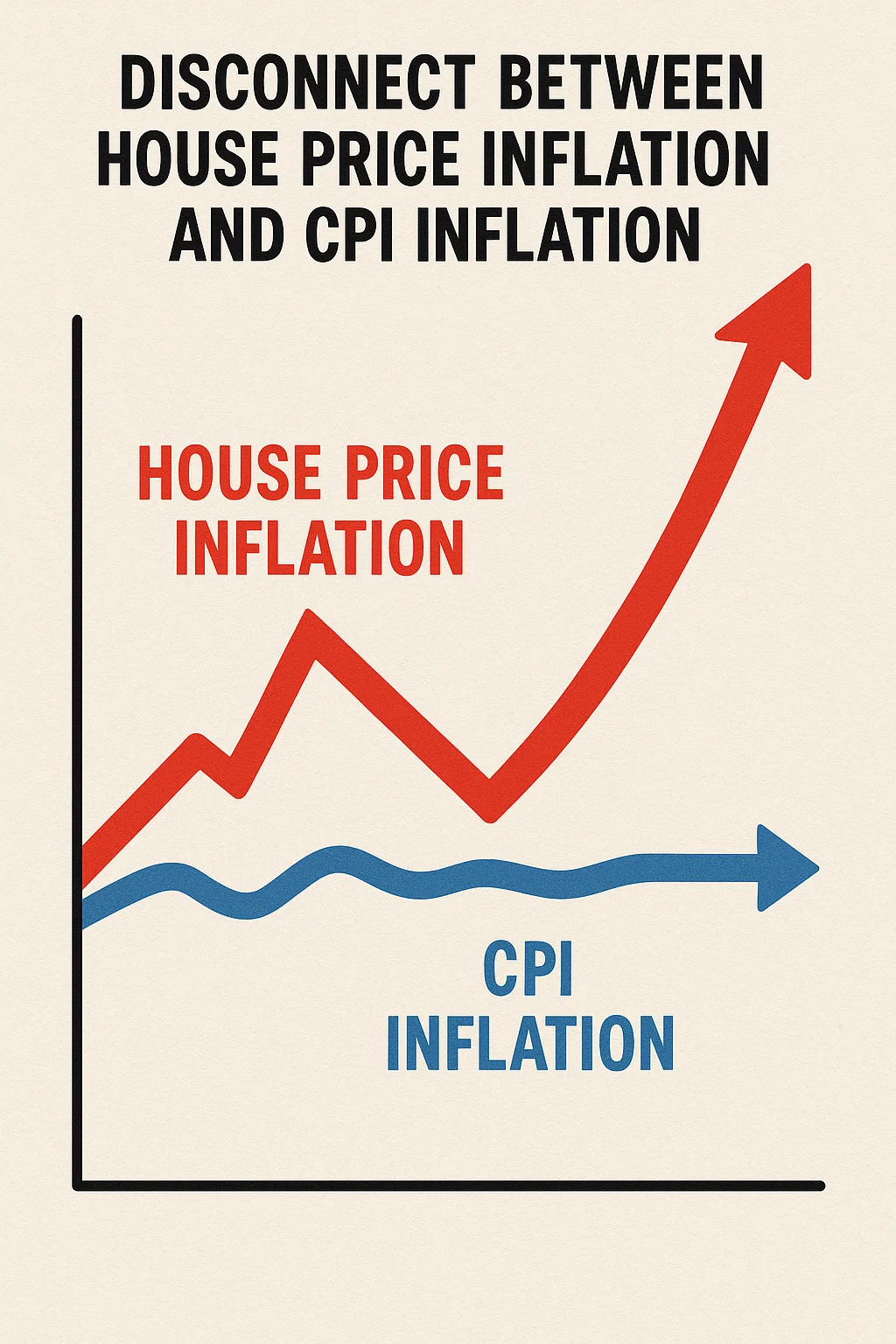

You're right to notice the disconnect between house price inflation and CPI inflation. CPI doesn't reflect everything that makes life harder to afford, especially in housing markets. That’s why many are calling for broader, complementary measures — because what’s measured shapes what’s managed.

In consideration of AI's analysis and how they distinguish the difference between "consumption" and "assets", and the definition of "Inflation" defined as the decline in the purchasing power of money.

Both "consumption" and "assets" are purchased with money, the only difference I can see is if a can of tomatoes goes up in price from $1 to $2 , you're down $1. But if a house price goes up from $500,000 to $700,000 in a year that's a big difference!

It comes down to this, we all need both shelter and food, both of these things are a fundamental necessity and both suffer from what we call inflation.

By not including existing house sales into Consumer Price Index calculations, we are being hoodwinked, deceived by a global cartel.